Top 3 Consumption Stocks in India for 2025: Complete Investment Guide

Reading Time: 12 minutes

Picture this: It’s a Saturday evening at a bustling shopping mall in Delhi. Families are grocery shopping at Big Bazaar, teenagers are trying on clothes at Westside, couples are dining at McDonald’s, and everyone’s paying through digital wallets. This scene, multiplied across thousands of cities and towns, represents one of the most powerful investment themes in India today.

India’s consumption story is not just about numbers – it’s about 1.4 billion people gradually improving their quality of life, one purchase at a time. As the country races toward becoming the world’s third-largest consumer market by 2030, smart investors are positioning themselves to benefit from this unprecedented transformation.

Key Investment Highlights

🚀 Market Opportunity: India’s consumer market is projected to grow 46% by 2030, reaching $4.3 trillion 🏆 Defensive Nature: Consumption stocks provide steady returns even during economic downturns 📈 Growth Drivers: Rising middle class, digital adoption, and changing consumer preferences 💰 Top Picks: HUL, Maruti Suzuki, and Titan Company leading their respective segments

Understanding India’s Consumption Revolution

What Are Consumption Stocks?

Consumption stocks represent companies that produce or sell goods and services used by households on a regular basis. These businesses thrive on consistent demand patterns and benefit directly from rising consumer incomes, urbanization, and lifestyle improvements.

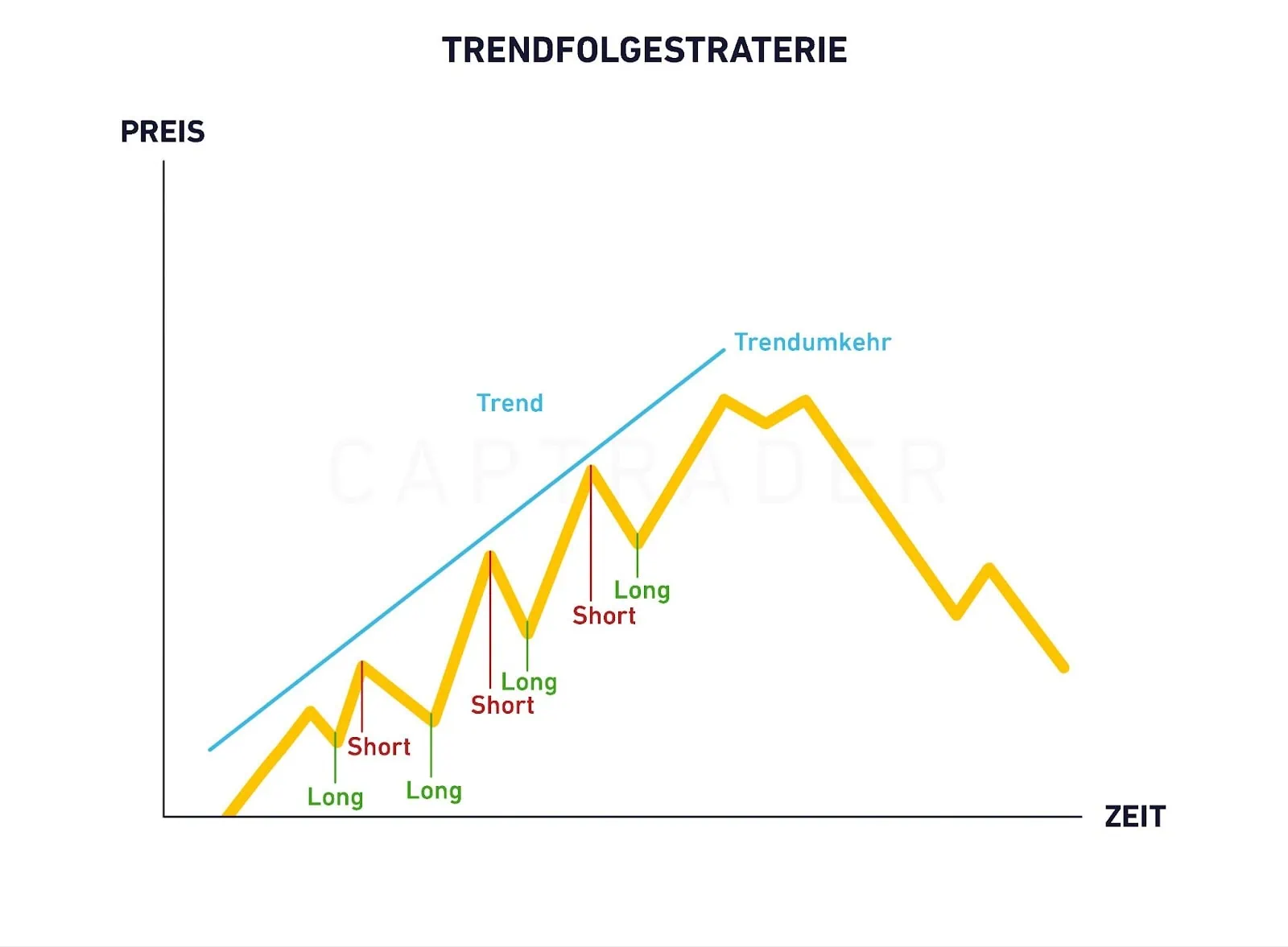

Unlike cyclical stocks that fluctuate with economic cycles, consumption stocks are considered defensive investments. They provide stable returns because people continue buying essential and semi-essential products regardless of economic conditions.

The National Stock Exchange tracks this sector through the Nifty India Consumption Index, which includes 30 companies across various consumer-focused industries, from fast-moving consumer goods (FMCG) to automobiles and lifestyle products.

Why India’s Consumer Market is Exploding

India’s consumption boom is driven by multiple structural factors that create a perfect storm for long-term growth:

Demographic Dividend: With over 65% of the population under 35 years and a median age of just 28.4 years, India has the world’s youngest consumer base. This young demographic is aspirational, digitally savvy, and willing to spend on quality products and experiences.

Economic Progress: Per capita disposable income has grown from $2,110 in 2019 to $2,540 in 2023, with projections reaching $4,340 by 2029. This 20% increase in purchasing power is translating directly into higher consumption across categories.

Digital Transformation: With over 850 million Indians online, e-commerce is revolutionizing how people shop. The online retail market is growing at 21% annually, while quick commerce and social commerce are expanding at an impressive 47% CAGR.

Key Drivers Behind India’s Consumption Boom

Rising Disposable Income and Middle Class Growth

India’s middle class is expanding rapidly, with upper-middle and high-income households expected to increase from 24 million in 2020 to over 80 million by 2030. This represents a 233% growth in affluent households over a decade.

As incomes rise, consumption patterns shift from necessity-based spending to discretionary purchases. Families are upgrading from local brands to national and international brands, seeking better quality, convenience, and status symbols.

Digital Commerce and E-commerce Explosion

The digital revolution is democratizing access to products and brands. Rural consumers can now purchase the same products as urban customers, breaking down geographical barriers that previously limited market reach.

Key digital trends driving consumption:

- E-commerce Growth: Expected to reach $350 billion by 2030

- Social Commerce: Influencer marketing and social media driving purchase decisions

- Quick Commerce: Same-day delivery changing consumer expectations

- Digital Payments: UPI and mobile wallets making transactions seamless

Urbanization and Rural Market Development

While urban areas continue leading consumption growth, rural markets are catching up rapidly. The rural-urban consumption gap is narrowing, with rural areas contributing 30-45% of revenue for many FMCG companies.

Government initiatives like digital infrastructure development, rural connectivity improvements, and agricultural reforms are boosting rural incomes and consumption capacity.

Credit Access and Financial Inclusion

India’s credit card market is expected to triple from 102 million in 2024 to 296 million by 2030. Easy credit access, combined with “Buy Now, Pay Later” options, is enabling higher consumption levels across income segments.

Digital lending platforms are making credit accessible to previously underserved populations, further expanding the consumer base for discretionary spending.

How to Evaluate Consumption Stocks for Investment

Financial Metrics That Matter

Revenue Growth Consistency: Look for companies with 10-15% annual revenue growth over 5-year periods. Volume-led growth is more sustainable than price-led growth.

Margin Expansion: Companies with improving gross margins and EBITDA margins demonstrate pricing power and operational efficiency.

Return on Capital Employed (ROCE): High ROCE indicates efficient capital utilization and strong business fundamentals.

Cash Flow Generation: Consistent free cash flow generation shows business stability and dividend sustainability.

Brand Strength and Market Position

Market Share: Companies with leading market positions have competitive advantages through scale, distribution, and brand recognition.

Brand Equity: Strong brands command premium pricing and customer loyalty, providing defensive moats against competition.

Distribution Network: Extensive distribution reaching rural and urban markets ensures consistent sales growth.

Innovation Pipeline: Companies investing in R&D and new product development maintain competitive advantages.

Management Quality and Strategic Vision

Track Record: Management teams with proven execution capabilities and strategic vision create long-term value.

Capital Allocation: Efficient capital allocation between growth investments, dividends, and share buybacks indicates management quality.

Adaptability: Companies that successfully navigate market changes and consumer trend shifts outperform peers.

Top 3 Consumption Stocks Analysis

1. Hindustan Unilever Ltd (HUL): The FMCG Giant

Company Overview: Hindustan Unilever is India’s largest FMCG company, with a diverse portfolio of over 50 brands across 16 categories. The company serves millions of Indian households daily through products ranging from personal care to food and beverages.

Key Strengths:

- Brand Portfolio: 19 brands generating over ₹1,000 crore annually, accounting for 80% of total revenue

- Market Leadership: Dominant positions in categories like soaps, detergents, and personal care

- Distribution Excellence: Unmatched reach across urban and rural markets

- Innovation Focus: Continuous product innovation and premiumization strategy

Financial Performance: HUL demonstrates consistent financial performance with stable margins and strong cash generation. The company’s focus on premiumization and rural penetration drives sustainable growth.

Investment Thesis: As Indian consumers upgrade to branded products and seek quality, HUL’s portfolio of trusted brands positions it perfectly for long-term growth. The company’s digital transformation and direct-to-consumer initiatives provide additional growth avenues.

Risks to Consider:

- Intense competition from local and international brands

- Raw material cost inflation impact on margins

- Changing consumer preferences toward natural and organic products

2. Maruti Suzuki India Ltd: Auto Sector Leader

Company Overview: Maruti Suzuki dominates India’s passenger vehicle market with over 45% market share. The company benefits from Suzuki’s global automotive expertise while maintaining cost leadership in the Indian market.

Key Strengths:

- Market Dominance: Undisputed leader in passenger vehicles with strong brand loyalty

- Product Portfolio: Wide range of vehicles across price segments

- Manufacturing Excellence: Efficient production facilities with 23.5 million units annual capacity

- Export Growth: Significant export business to 100+ countries

Financial Performance: Strong revenue growth driven by volume expansion and new model launches. The company maintains healthy margins through operational efficiency and scale advantages.

Investment Thesis: India’s vehicle penetration remains low compared to developed markets, providing significant growth runway. Rising incomes, improving road infrastructure, and shift toward personal mobility support long-term demand.

Risks to Consider:

- Electric vehicle transition disrupting traditional automotive industry

- Commodity price volatility affecting input costs

- Regulatory changes and emission norms compliance costs

3. Titan Company Ltd: Jewelry and Lifestyle Pioneer

Company Overview: Titan Company is India’s leading jewelry retailer and fifth-largest integrated watch manufacturer globally. The company has successfully built strong brands across jewelry, watches, and eyewear segments.

Key Strengths:

- Market Leadership: Dominant position in organized jewelry retail

- Brand Portfolio: Strong brands including Tanishq, Titan, and Fastrack

- Retail Network: Extensive store network with 3,171 stores across 429 towns

- Diversification: Multiple product categories reducing dependency risk

Financial Performance: Strong revenue growth driven by store expansion and same-store sales growth. The company maintains healthy margins through brand positioning and operational efficiency.

Investment Thesis: India’s jewelry market is transitioning from unorganized to organized retail, benefiting established players like Titan. Rising disposable incomes and changing consumer preferences toward branded jewelry support growth.

Risks to Consider:

- Gold price volatility affecting consumer demand

- Competition from local jewelers and online platforms

- Economic slowdown impact on discretionary spending

Investment Strategy for Consumption Stocks

Portfolio Allocation Approach

Core Holdings (60-70%): Establish positions in market leaders like HUL and Maruti Suzuki for stability and consistent returns.

Growth Bets (20-30%): Invest in companies like Titan that benefit from structural trends and market share gains.

Satellite Positions (10-20%): Consider smaller consumption companies with niche positions or emerging opportunities.

Timing and Valuation Considerations

Valuation Discipline: Consumption stocks often trade at premium valuations due to their defensive nature. Focus on companies with reasonable valuations relative to growth prospects.

Systematic Investment: Use systematic investment plans (SIPs) to benefit from rupee-cost averaging and reduce timing risk.

Long-term Perspective: Consumption stocks reward patient investors who can hold through economic cycles.

Risk Management Strategies

Diversification: Spread investments across different consumption categories to reduce concentration risk.

Quality Focus: Prioritize companies with strong balance sheets, consistent cash flows, and competitive advantages.

Regular Review: Monitor changing consumer trends and company performance to make timely adjustments.

Risks and Considerations

Market Risks

Economic Slowdown: Consumption stocks can be affected by economic downturns, though they’re generally more resilient than cyclical stocks.

Inflation Impact: Rising input costs can pressure margins if companies cannot pass through price increases.

Competition: Intense competition from local and international players can affect market share and profitability.

Sector-Specific Risks

Changing Consumer Preferences: Shifts toward health, sustainability, and digital-first brands can disrupt established players.

Regulatory Changes: New regulations related to advertising, packaging, or product standards can increase compliance costs.

Supply Chain Disruptions: Global supply chain issues can affect product availability and costs.

Investment Risks

Valuation Risk: High valuations can limit returns if growth expectations are not met.

Concentration Risk: Over-exposure to consumption stocks can reduce portfolio diversification benefits.

Liquidity Risk: Some smaller consumption stocks may have lower trading volumes affecting liquidity.

Future Outlook and Conclusion

India’s consumption story is just beginning. With favorable demographics, rising incomes, and structural reforms supporting growth, the next decade presents unprecedented opportunities for consumption companies.

The companies that will thrive are those with:

- Strong brand equity and customer loyalty

- Efficient distribution networks reaching all market segments

- Innovation capabilities to meet evolving consumer needs

- Digital transformation strategies for omnichannel presence

- Sustainable business practices aligned with consumer values

Key Takeaways for Investors

- Long-term Opportunity: India’s consumption growth is a multi-decade trend, not a short-term cycle

- Quality Focus: Prioritize companies with strong fundamentals and competitive advantages

- Diversification: Spread investments across different consumption categories and company sizes

- Patience Required: Consumption stocks reward long-term investors who can hold through volatility

- Stay Informed: Monitor changing consumer trends and company adaptations

Ready to Invest in India’s Consumption Revolution?

The consumption sector offers compelling opportunities for investors seeking stable, long-term growth. Companies like HUL, Maruti Suzuki, and Titan are well-positioned to benefit from India’s structural consumption growth.

Next Steps:

- Assess your risk tolerance and investment timeline

- Research individual companies thoroughly

- Consider starting with small positions in market leaders

- Implement a systematic investment approach

- Monitor portfolio performance and rebalance as needed

India’s consumption revolution is transforming millions of lives while creating substantial wealth for investors. By understanding the trends, evaluating companies carefully, and maintaining a long-term perspective, you can participate in one of the most exciting investment themes of our time.

Frequently Asked Questions

Q: What stocks are included in the Nifty Consumption Index? A: The Nifty Consumption Index includes 30 companies across consumer-oriented businesses like FMCG, automotive, and retail. Major constituents include Hindustan Unilever, ITC, Nestlé India, Titan, Asian Paints, Maruti Suzuki, and Marico.

Q: Are consumption stocks safe investments? A: Consumption stocks are generally considered defensive investments due to their stable cash flows, consistent demand, and lower volatility compared to cyclical stocks. However, they still carry market risks and should be part of a diversified portfolio.

Q: How do I start investing in consumption stocks? A: Begin by researching leading companies in different consumption categories, assess their financial health and growth prospects, start with small positions in market leaders, and consider systematic investment plans for rupee-cost averaging.

Q: What percentage of my portfolio should be in consumption stocks? A: This depends on your risk tolerance and investment goals. Generally, 15-25% allocation to consumption stocks can provide good diversification benefits while participating in India’s growth story.

Q: Which consumption sector has the best growth prospects? A: All consumption sectors have growth potential, but personal care, health & wellness, digital-first brands, and organized retail are showing particularly strong growth trends driven by changing consumer preferences.

Disclaimer: This content is for educational purposes only and should not be considered as investment advice. Stock investments carry market risks, and past performance doesn’t guarantee future results. Please consult with a qualified financial advisor before making investment decisions.

About OfferSathi.com: Your trusted source for investment insights, market analysis, and financial education. Making complex financial concepts simple and accessible for every investor.