Will Jio BlackRock Transform Mutual Fund Investing for Every Indian?

Reading Time: 8 minutes

Imagine investing in mutual funds as easily as recharging your mobile phone. That’s exactly what Jio BlackRock mutual funds promise to deliver to millions of Indians who have been left out of the investment revolution. But can this ambitious partnership truly democratize wealth creation for the masses?

With over 46% of Indian household savings still stuck in traditional bank deposits, the mutual fund industry has a massive opportunity – and an equally massive challenge. Enter Jio BlackRock, a game-changing alliance that could rewrite the rules of retail investing in India.

Understanding Jio BlackRock: The Game-Changing Partnership

What Makes This Partnership Special?

Jio BlackRock represents more than just another mutual fund company. It’s a strategic fusion of two powerhouses:

Jio Financial Services brings:

- Access to 400+ million digital users

- Deep understanding of Indian consumer behavior

- Extensive digital infrastructure across urban and rural India

- Proven track record of making complex services simple

BlackRock Inc. contributes:

- $11.58 trillion in global assets under management

- Cutting-edge Aladdin platform for risk management

- Decades of investment expertise

- Institutional-grade technology and analytics

This 50:50 joint venture, backed by $300 million in initial funding, isn’t just about launching another mutual fund. It’s about solving a fundamental problem: why do only 8.4% of Indian household savings flow into mutual funds despite their proven benefits?

The Journey So Far

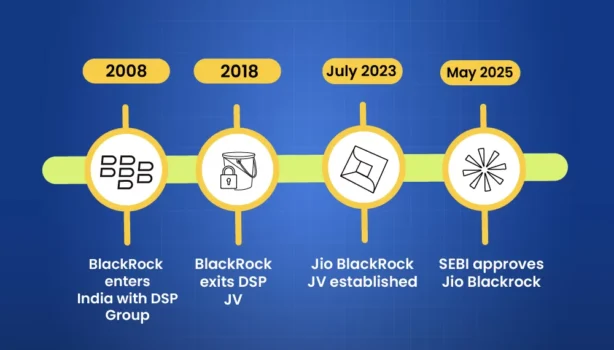

BlackRock’s relationship with India has been a story of learning and adaptation. After their first venture with DSP Group (2008-2018) ended, they took time to understand what Indian investors truly needed. The 2023 partnership with Jio represents their comeback – but this time, they’re not just entering India; they’re reimagining how Indians invest.

The regulatory approval from SEBI in May 2025 marked a crucial milestone, with industry veteran Sid Swaminathan taking the helm as CEO. His experience managing $1.25 trillion in assets provides the credibility needed to execute this ambitious vision.

The Current State of Mutual Fund Adoption in India

The Numbers Tell a Story

Despite India’s economic growth and digital revolution, mutual fund adoption remains surprisingly low:

- 2020-21: Only 7.6% of household savings went to mutual funds

- 2021-22: Slight improvement to 8.5%

- 2022-23: Marginal decline to 8.4%

Meanwhile, traditional instruments dominated:

- Bank deposits: 46%+ consistently

- Fixed deposits and insurance: Still preferred over market-linked options

- Gold and real estate: Continued to attract significant savings

Why Haven’t Mutual Funds Caught On?

The accessibility gap isn’t just about availability – it’s about perception, trust, and understanding:

- The Risk Perception Problem Most Indians still view mutual funds as “stock market gambling.” This misconception stems from limited financial education and high-profile market crashes that created lasting negative impressions.

- The Trust Deficit In Tier-2 and Tier-3 cities, where wealth creation potential is highest, mutual funds remain mysterious products sold by people who may not fully understand them themselves.

- The Complexity Barrier Terms like NAV, expense ratios, and exit loads confuse potential investors. When faced with complexity, Indians default to familiar options like FDs, even at lower returns.

- The Guaranteed Returns Mindset Cultural preference for certainty over growth means many Indians choose 6% guaranteed returns over potentially higher but variable mutual fund returns.

How Jio BlackRock Plans to Bridge the Investment Gap

A Revolutionary Approach

Jio BlackRock’s strategy isn’t just about launching mutual funds – it’s about reimagining the entire investment experience:

- Mobile-First, Mass-Market Distribution Instead of relying on distributors or physical branches, Jio BlackRock leverages existing Jio ecosystem touchpoints:

- MyJio app integration

- JioMart cross-selling opportunities

- JioFiber customer engagement

- Seamless onboarding through existing Jio services

- Radical Pricing Strategy Their initial offering includes zero expense ratio funds:

- JioBlackRock Money Market Fund

- JioBlackRock Overnight Fund

- JioBlackRock Liquid Fund

This isn’t just competitive pricing – it’s disruptive pricing that removes cost as a barrier to entry.

- Technology That Democratizes Expertise BlackRock’s Aladdin platform, typically reserved for institutional investors, becomes accessible to retail investors. This means:

- Professional-grade risk management

- Advanced portfolio analytics

- Real-time monitoring and alerts

- Institutional-quality research and insights

- Simplification Without Dumbing Down The platform focuses on education and clarity:

- Plain language explanations

- Visual representations of complex concepts

- Regional language support

- Contextual help and guidance

The Strategic Advantage

Unlike traditional mutual fund companies that target existing investors, Jio BlackRock is building for the uninitiated. Their approach recognizes that India’s next 100 million investors won’t come from metro cities – they’ll come from the digital natives in smaller towns who trust the Jio brand.

Potential Challenges on the Road to Mass Adoption

The Behavioral Challenge

Changing Investment Mindsets The biggest obstacle isn’t technological – it’s psychological. Convincing Indians to move from guaranteed 6% returns to variable but potentially higher returns requires more than just better technology.

Building Long-Term Investment Habits Indian investors often have short-term mindsets. Creating patient, long-term investors requires ongoing education and support systems.

The Competitive Landscape

Established Players Fight Back Companies like Zerodha, Groww, and Paytm Money already serve digitally-savvy investors. Jio BlackRock must differentiate beyond just pricing.

The Fintech Challenge New-age platforms offer user-friendly experiences and are constantly innovating. Staying ahead requires continuous platform development and feature enhancement.

Operational Complexities

Scaling Customer Service Managing millions of first-time investors requires robust customer support systems in multiple languages and formats.

Regulatory Compliance at Scale SEBI regulations become more complex when dealing with mass-market, first-time investors who may not fully understand risk disclosures.

Technology Infrastructure Handling millions of small transactions requires robust, scalable technology infrastructure that can handle peak loads without compromising user experience.

The Future of Mutual Fund Investing in India

What Success Looks Like

If Jio BlackRock succeeds, we could see:

- Mutual fund penetration rising from 8% to 20%+ of household savings

- Investment becoming as common as mobile recharging

- A new generation of informed, long-term investors

- Reduced wealth inequality through accessible wealth creation tools

The Ripple Effect

Success could inspire:

- Traditional AMCs to adopt more aggressive digital strategies

- Fintech companies to focus on financial inclusion

- Regulators to create more supportive frameworks for mass-market investing

- Educational institutions to integrate financial literacy into curricula

Key Success Factors

- Consistent Performance Zero fees mean nothing if funds underperform. Jio BlackRock must deliver competitive returns consistently.

- Educational Excellence Converting non-investors requires exceptional educational content and support systems.

- Trust Building The Jio brand provides initial trust, but sustained trust requires transparent communication and reliable service.

- Continuous Innovation The digital investing space evolves rapidly. Staying relevant requires ongoing platform enhancement and feature development.

Conclusion: A Potential Game-Changer

Jio BlackRock represents more than a new mutual fund company – it’s a bold experiment in financial inclusion. By combining Jio’s digital reach with BlackRock’s investment expertise, they’re positioned to solve problems that have limited mutual fund adoption for decades.

The question isn’t whether they can launch successfully – SEBI approval and initial fund launches prove they can. The real question is whether they can sustain growth, build trust, and create lasting behavioral change among Indian investors.

If they succeed, Jio BlackRock could become the catalyst that transforms India’s savings culture, moving millions from low-return traditional instruments to wealth-building mutual funds. If they fail, it will likely be due to underestimating the complexity of changing deeply ingrained financial behaviors.

The stakes are high, but so is the opportunity. For Indian investors, Jio BlackRock represents a chance to access world-class investment management at zero cost. For the Indian economy, it could mean channeling household savings more efficiently toward productive investments.

The next two years will be crucial. Will Jio BlackRock succeed in making mutual funds as ubiquitous as mobile phones in India? Only time will tell, but the potential for transformation is undeniable.

What do you think about Jio BlackRock’s approach? Share your thoughts in the comments below, and don’t forget to subscribe to our newsletter for more insights on fintech and investment trends in India.