Stock Market Basics: The Complete Guide for New Investors in 2025

Reading Time: 15 minutes

The stock market can feel like a foreign language when you’re just starting out. Terms like “market cap,” “P/E ratio,” and “dividend yield” get thrown around like everyone should know what they mean. Charts look like abstract art, and the constant stream of financial news can be overwhelming.

But here’s the truth: every successful investor started exactly where you are right now. Warren Buffett didn’t emerge from the womb knowing how to read a balance sheet, and Peter Lynch wasn’t born understanding market psychology. They learned the fundamentals, practiced consistently, and built their knowledge over time.

As we navigate through 2025, the stock market remains one of the most powerful wealth-building tools available to ordinary people. If you’re ready to stop watching from the sidelines and start participating in the greatest wealth-creation machine in human history, this comprehensive guide will give you the foundation you need.

Key Investment Insights for 2025

💰 Long-Term Wealth Building Is Accessible to Everyone

You don’t need to be rich to start investing. With fractional shares and low-cost brokers, you can begin building wealth with as little as $10 and access the same investment opportunities as millionaires.

📊 Knowledge Is Your Greatest Asset

The difference between successful investors and those who lose money isn’t luck or timing – it’s understanding. Master the basics, and you’ll make better decisions than 90% of market participants.

🎯 Simple Strategies Often Work Best

While Wall Street promotes complex strategies, history shows that simple, consistent approaches to investing often outperform sophisticated trading systems. Focus on fundamentals, not complexity.

⚡ Technology Has Democratized Investing

Modern investing platforms provide tools and information that were once available only to professional investors. The playing field has never been more level for individual investors.

Why Understanding Stock Market Basics Is Your First Step to Financial Freedom

Investing in the stock market isn’t gambling – it’s participating in the growth of the world’s most successful companies. When you buy a share of stock, you’re buying a piece of a real business with real assets, real employees, and real profits.

The Power of Compound Growth

The stock market’s long-term average return of about 10% annually might not sound exciting, but compound growth makes it magical. A $10,000 investment growing at 10% annually becomes $67,275 in 20 years and $174,494 in 30 years – without adding another penny.

This isn’t theory; it’s historical fact. The companies that make up the stock market are constantly innovating, expanding, and finding new ways to create value. As an investor, you get to participate in this growth.

Why Most People Avoid the Stock Market (And Why They Shouldn’t)

Many people avoid investing because they think it’s too complicated, too risky, or requires too much money. These misconceptions keep millions of people from building wealth:

“It’s too complicated” – While advanced strategies can be complex, basic investing is straightforward. Buy shares in good companies, hold them for the long term, and let compound growth work its magic.

“It’s too risky” – The stock market has risks, but not investing is riskier. Inflation erodes the purchasing power of cash over time, while stocks have historically provided returns that exceed inflation.

“I don’t have enough money” – Many brokers now offer fractional shares, allowing you to invest in expensive stocks with small amounts. You can start building wealth with whatever you can afford.

Essential Stock Market Concepts Every Investor Must Understand

Before you can make smart investment decisions, you need to understand the language of the market. These fundamental concepts form the foundation of all investment analysis.

Market Capitalization: Understanding Company Size

Market capitalization, or “market cap,” represents the total value of a company’s shares in the stock market. It’s calculated by multiplying the stock price by the number of shares outstanding.

Market Cap Categories:

- Large-Cap ($10+ billion): Established companies like Apple, Microsoft, and Amazon

- Mid-Cap ($2-10 billion): Growing companies with expansion potential

- Small-Cap ($300 million-$2 billion): Smaller companies with higher growth potential but more risk

Why Market Cap Matters: Market cap helps you understand what type of investment you’re making. Large-cap stocks tend to be more stable but grow more slowly. Small-cap stocks can grow rapidly but are more volatile.

Real-World Example: If Company A has 100 million shares trading at $50 each, its market cap is $5 billion (100 million × $50). This makes it a mid-cap stock, suggesting it’s an established company with room for growth.

Price-to-Earnings (P/E) Ratio: Measuring Value

The P/E ratio is one of the most important valuation metrics in investing. It tells you how much investors are willing to pay for each dollar of a company’s earnings.

P/E Ratio Formula: P/E Ratio = Stock Price ÷ Earnings Per Share (EPS)

Interpreting P/E Ratios:

- Low P/E (under 15): May indicate undervalued stock or declining business

- Moderate P/E (15-25): Typical for mature, stable companies

- High P/E (over 25): Suggests high growth expectations or overvaluation

Industry Context Matters: Tech companies often have higher P/E ratios because investors expect rapid growth. Utility companies typically have lower P/E ratios because they’re stable but slow-growing.

Practical Application: If Stock A trades at $100 with earnings of $5 per share, its P/E is 20. If Stock B trades at $50 with earnings of $2 per share, its P/E is 25. Stock A might be the better value, but you need to consider growth prospects and industry norms.

Dividend Yield: Understanding Income Potential

Dividend yield measures the annual dividend payment as a percentage of the stock price. It’s crucial for income-focused investors.

Dividend Yield Formula: Dividend Yield = (Annual Dividend Per Share ÷ Stock Price) × 100

Yield Interpretation:

- High yield (4%+): May indicate mature company or potential problems

- Moderate yield (2-4%): Typical for stable, dividend-paying companies

- Low/No yield (0-2%): Growth companies that reinvest profits

The Dividend Growth Advantage: Companies that consistently increase their dividends often make excellent long-term investments. These “dividend aristocrats” have raised their dividends for 25+ consecutive years.

Earnings Per Share (EPS): Measuring Profitability

EPS represents how much profit a company generates for each share of stock. It’s a key metric for evaluating a company’s profitability and growth.

EPS Formula: EPS = (Net Income – Preferred Dividends) ÷ Average Outstanding Shares

EPS Growth Trends:

- Consistent growth: Indicates a healthy, expanding business

- Declining EPS: May signal business problems or economic headwinds

- Volatile EPS: Suggests cyclical business or management issues

Why EPS Matters: EPS growth drives stock price appreciation over time. Companies that consistently grow their earnings typically see their stock prices rise accordingly.

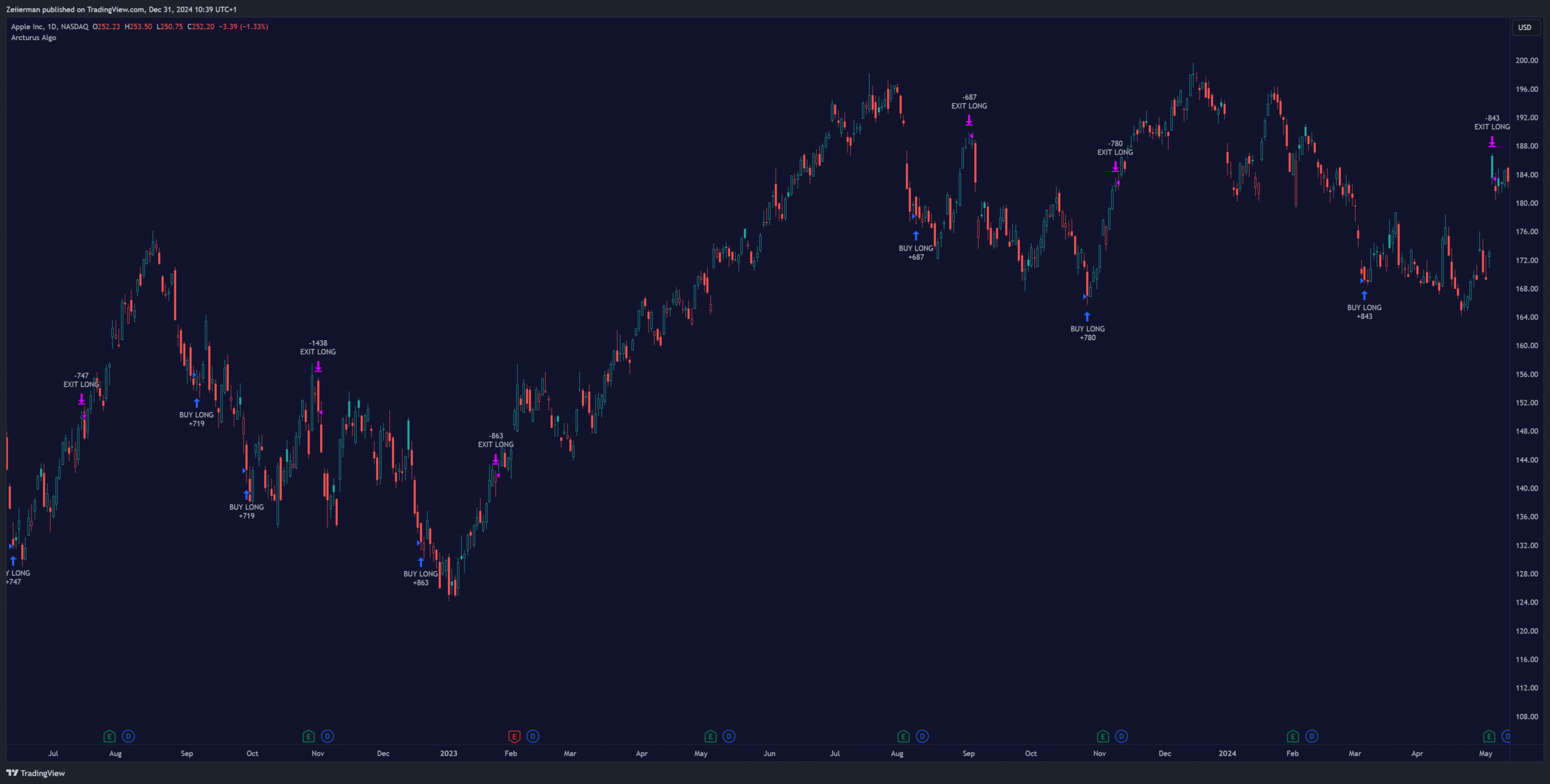

How to Read Stock Charts: Your Visual Guide to Market Behavior

Stock charts might look intimidating, but they’re simply visual representations of supply and demand. Learning to read them gives you insights into market sentiment and potential price movements.

Understanding Chart Basics

Price Action: The vertical axis shows price levels, while the horizontal axis shows time. Every chart tells the story of how much investors were willing to pay for a stock over a specific period.

Time Frames:

- Daily charts: Show price movements over days or weeks

- Weekly charts: Display longer-term trends over months

- Monthly charts: Reveal long-term patterns over years

- Intraday charts: Show minute-by-minute or hourly movements

Support and Resistance Levels

Support levels are price points where a stock tends to find buying interest and bounce higher. Think of it as a floor that holds up the price.

Resistance levels are price points where selling pressure tends to emerge, preventing further price increases. These act like a ceiling that caps price gains.

How to Identify Support and Resistance: Look for price levels where the stock has bounced multiple times. The more times a level holds, the more significant it becomes.

Trading Implications:

- Buying near support levels can offer good risk/reward ratios

- Selling near resistance levels can help lock in profits

- Breakouts above resistance or below support often signal significant moves

Volume: The Foundation of Price Movements

Volume represents the number of shares traded during a specific period. It confirms the strength of price movements and reveals institutional interest.

Volume Patterns:

- High volume + rising prices: Strong buying interest (bullish)

- High volume + falling prices: Strong selling pressure (bearish)

- Low volume + price movement: Weak trend, likely to reverse

- Volume spikes: Often precede significant price moves

Professional Insight: Price movements without volume support are often temporary. Look for volume confirmation before making investment decisions.

Trend Analysis: Following Market Direction

Uptrend Characteristics:

- Higher highs and higher lows

- Price above moving averages

- Increasing volume on rallies

Downtrend Characteristics:

- Lower highs and lower lows

- Price below moving averages

- Increasing volume on declines

Sideways/Consolidation:

- Price moves within a defined range

- Neither buyers nor sellers in control

- Often precedes significant breakouts

Building Your First Stock Portfolio: A Step-by-Step Guide

Creating a well-diversified portfolio doesn’t require a finance degree. Follow these proven principles to build a foundation for long-term wealth.

The Asset Allocation Framework

Age-Based Allocation: A simple rule of thumb: subtract your age from 100 to determine your stock allocation. A 30-year-old might have 70% stocks and 30% bonds, while a 60-year-old might prefer 40% stocks and 60% bonds.

Risk Tolerance Considerations:

- Conservative: 40-60% stocks, focus on dividend-paying companies

- Moderate: 60-80% stocks, balanced growth and income approach

- Aggressive: 80-100% stocks, emphasis on growth companies

Diversification Strategies

Sector Diversification: Don’t put all your money in one industry. Spread investments across:

- Technology (innovation and growth)

- Healthcare (demographic trends)

- Consumer goods (stable demand)

- Financial services (economic growth)

- Energy and utilities (essential services)

Geographic Diversification: Include both domestic and international stocks to reduce country-specific risks and capture global growth opportunities.

Company Size Diversification: Combine large-cap stability with mid-cap growth potential and small-cap opportunities.

Stock Selection Criteria

Financial Health Indicators:

- Debt-to-equity ratio: Lower is generally better

- Current ratio: Should be above 1.0

- Return on equity (ROE): Higher indicates efficient management

- Revenue growth: Consistent growth over time

Competitive Advantages: Look for companies with “moats” – sustainable competitive advantages that protect their market position:

- Brand recognition (Coca-Cola, Nike)

- Network effects (Facebook, Amazon)

- Patents and intellectual property

- Cost advantages or operational efficiency

Dollar-Cost Averaging: Your Risk Management Strategy

Instead of investing a lump sum, dollar-cost averaging involves investing fixed amounts regularly over time. This strategy reduces the impact of market volatility and removes the pressure of trying to time the market.

Benefits of Dollar-Cost Averaging:

- Reduces average purchase price over time

- Eliminates timing decisions

- Builds investing discipline

- Works in all market conditions

Implementation: Set up automatic investments of $100, $500, or whatever you can afford on a monthly basis. This systematic approach often outperforms trying to time the market.

Common Beginner Mistakes (And How to Avoid Them)

Learning from others’ mistakes can save you time, money, and frustration. Here are the most common pitfalls new investors face:

Emotional Decision Making

The Fear and Greed Cycle: New investors often buy when markets are high (driven by greed) and sell when markets are low (driven by fear). This emotional rollercoaster destroys wealth over time.

Solution: Develop an investment plan and stick to it regardless of market conditions. Successful investing is boring – it’s about consistent, disciplined execution.

Lack of Diversification

Concentration Risk: Putting too much money in one stock, sector, or asset class exposes you to unnecessary risk. Even great companies can face unexpected challenges.

Solution: Spread your investments across different stocks, sectors, and asset classes. If you can’t afford individual diversification, consider low-cost index funds.

Trying to Time the Market

The Timing Trap: Studies show that even professional investors struggle to consistently time market movements. Trying to buy at the bottom and sell at the top usually results in the opposite.

Solution: Focus on time in the market, not timing the market. Consistent, long-term investing beats short-term speculation.

Neglecting Research

The Hot Tip Syndrome: Following stock tips from friends, social media, or financial TV without doing your own research is a recipe for losses.

Solution: Understand what you’re buying. Research the company’s business model, financial health, and competitive position before investing.

Overcomplicating the Process

Analysis Paralysis: Some new investors become overwhelmed by the amount of information available and either never start investing or constantly second-guess their decisions.

Solution: Start simple with broad market index funds, then gradually learn more advanced concepts as you gain experience.

Investment Tools and Resources for Success

Having the right tools and resources can significantly improve your investment outcomes. Here’s what you need to get started:

Essential Investment Platforms

Full-Service Brokers: Provide research, advice, and comprehensive services but charge higher fees. Good for beginners who want guidance.

Discount Brokers: Offer low-cost trading with basic research tools. Perfect for self-directed investors who want to keep costs low.

Robo-Advisors: Automated investment platforms that create and manage diversified portfolios based on your risk tolerance and goals.

Research Resources

Free Resources:

- Company annual reports and SEC filings

- Yahoo Finance and Google Finance for basic data

- Morningstar for mutual fund and ETF analysis

- FRED (Federal Reserve Economic Data) for economic indicators

Paid Resources:

- Value Line Investment Survey for comprehensive stock analysis

- Bloomberg Terminal for professional-grade data

- Seeking Alpha for investment research and opinions

Portfolio Management Tools

Tracking Software:

- Personal Capital for comprehensive portfolio tracking

- Morningstar Portfolio Manager for analysis

- Spreadsheet templates for DIY tracking

Tax-Advantaged Accounts:

- 401(k) for employer-sponsored retirement savings

- IRA for individual retirement planning

- Roth IRA for tax-free growth

- HSA for healthcare expenses (triple tax advantage)

The Psychology of Successful Investing

Understanding market psychology – both your own and that of other investors – is crucial for long-term success. The stock market is driven by human emotions, and recognizing these patterns gives you a significant advantage.

Behavioral Biases That Hurt Performance

Confirmation Bias: Seeking information that confirms your existing beliefs while ignoring contradictory evidence.

Overconfidence Bias: Believing you’re better at predicting market movements than you actually are.

Loss Aversion: Feeling the pain of losses more acutely than the pleasure of gains, leading to poor selling decisions.

Herd Mentality: Following the crowd instead of making independent decisions based on facts.

Developing an Investor’s Mindset

Think Like an Owner: When you buy a stock, you’re buying a piece of a business. Think about whether you’d want to own the entire company.

Focus on Value Creation: Successful companies create value for customers, employees, and shareholders. Look for businesses with sustainable competitive advantages.

Embrace Volatility: Market volatility is the price you pay for higher long-term returns. View temporary declines as opportunities to buy quality companies at better prices.

Stay Disciplined: Successful investing requires patience and discipline. Stick to your plan even when markets are volatile or when others are panicking.

Building Wealth Through Stock Market Investing: Your Action Plan

Now that you understand the fundamentals, it’s time to put your knowledge into action. Successful investing isn’t about perfect timing or picking the next big winner – it’s about consistent, disciplined execution over time.

Phase 1: Foundation Building (Months 1-3)

Step 1: Set Clear Goals

- Define your investment timeline (retirement, house purchase, etc.)

- Determine your risk tolerance

- Calculate how much you can invest monthly

Step 2: Open Investment Accounts

- Choose a reputable broker or robo-advisor

- Open tax-advantaged accounts (401k, IRA) first

- Set up automatic transfers to build consistency

Step 3: Start Simple

- Begin with broad market index funds

- Focus on low costs and diversification

- Avoid complex strategies until you gain experience

Phase 2: Knowledge Expansion (Months 4-12)

Step 1: Learn Company Analysis

- Practice reading annual reports

- Understand key financial metrics

- Start following companies you know and use

Step 2: Develop Your Investment Process

- Create a simple checklist for evaluating stocks

- Set criteria for buying and selling

- Track your decisions and results

Step 3: Expand Your Holdings

- Add individual stocks to your portfolio

- Consider international diversification

- Explore sector-specific opportunities

Phase 3: Portfolio Optimization (Year 2 and Beyond)

Step 1: Refine Your Strategy

- Analyze what’s working and what isn’t

- Adjust allocation based on life changes

- Consider more advanced strategies

Step 2: Tax Optimization

- Maximize tax-advantaged account contributions

- Understand tax-loss harvesting

- Consider asset location strategies

Step 3: Continuous Learning

- Stay updated on market developments

- Learn from successful investors

- Adapt your strategy as markets evolve

Your Investment Journey Starts Today

Stock market investing in 2025 isn’t about getting rich quick – it’s about building sustainable wealth over time. The investors who succeed are those who start early, stay consistent, and continuously educate themselves.

You now have the foundational knowledge to begin your investment journey. The key is to start, even if it’s with a small amount. Every dollar you invest today has the potential to grow significantly over time through the power of compound returns.

Remember: the best time to start investing was yesterday. The second-best time is today.

Your Next Steps:

- Calculate your monthly investment capacity

- Open a brokerage account with a reputable firm

- Start with broad market index funds

- Set up automatic monthly investments

- Continue learning and gradually expand your knowledge

- Stay disciplined and think long-term

Getting Started Resources:

- Beginner-friendly brokers: Fidelity, Schwab, Vanguard

- Robo-advisors: Betterment, Wealthfront, Schwab Intelligent Portfolios

- Educational resources: SEC.gov investor education, Khan Academy

- Market data: Yahoo Finance, Google Finance, Morningstar

- News and analysis: Wall Street Journal, Financial Times, Barron’s

The stock market has created more millionaires than any other investment vehicle in history. By understanding the basics, starting early, and staying disciplined, you can build the wealth you need to achieve your financial goals.

Your financial future depends on the decisions you make today. The knowledge is in your hands, the tools are available, and the opportunity is waiting.

The question isn’t whether you can succeed in the stock market – it’s whether you’ll start your journey today.

Disclaimer: This content is for educational purposes only and should not be considered financial advice. Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results. Always consult with a qualified financial advisor before making investment decisions.

About InvestSmart.com: Your trusted source for investment education, market analysis, and wealth-building strategies. Learn the fundamentals, invest with confidence, and build your financial future through smart investing.